Introduction to Leveraging Credit for Business Growth

Starting a business often requires significant capital, and many entrepreneurs find themselves struggling to save enough money to get started. As one speaker shared, “I was trying to save, like, twenty, thirty thousand to start my business,” but found it challenging to accumulate the necessary funds over a year or two. This highlights a common obstacle faced by many aspiring business owners.

However, there is an alternative approach that can expedite access to the needed capital/leveraging credit. The speaker revealed a pivotal insight, noting, “It’s easier to get approved for fifty k.” By obtaining approval for two credit cards, each with a limit of twenty-five thousand dollars, they were able to access fifty thousand dollars in just one day. This revelation underscores the importance of understanding both personal and business credit as tools for business growth.

Building a Strong Credit Profile

Building a strong credit profile is essential for leveraging financial opportunities, especially in business. The journey often begins with understanding both personal and business credit.

“I had to learn everything about personal credit, everything about business credit.”

Learning About Personal and Business Credit

The realization that saving money might not be the most efficient way to gather capital can be eye-opening. For instance, it might take years to save a significant amount like fifty thousand dollars, but with a strong credit profile, you could be approved for the same amount in a single day. This understanding can shift your approach to financing.

The Journey of Understanding Credit Systems

To build a robust credit profile, immerse yourself in learning. Dedicate time to understanding the intricacies of credit systems. This might involve late nights and extensive research, but the payoff can be substantial.

Leveraging Credit for Business and Investments

Once you have a solid grasp of credit, you can leverage it to start businesses and make investments. This strategic use of credit can accelerate your financial growth and open up new opportunities.

Structuring Your LLC for Financial Success

Structuring your LLC correctly is crucial for financial success, especially when leveraging credit to fund your business ventures. Here’s a step-by-step guide to ensure your LLC is set up for success:

- Set Up a Business Phone Number and Email “You would rather start your business with a non-risky business name.”

- Why It Matters: Banks often view certain business names as risky, which can hinder your ability to secure funding. Avoid names that suggest high-risk industries.

- Example: Instead of “KP Credit Repair Business,” opt for something like “KP Wealth Enterprises.”

- Set Up a Business Phone Number and Email

- Business Phone Number: Establish a dedicated phone line for your business to enhance credibility.

- Business Email: Use a professional email address that matches your business domain.

- Establish a Business Address and Online Presence

- Business Address: Secure a physical or virtual address for your business.

- Online Presence: Create a website and social media profiles to increase visibility and trust.

All these components are essential when it comes time to access significant funding. Proper structuring from the start can make a substantial difference in your business’s financial trajectory.

Optimizing Personal Credit for Business Funding

Optimizing your personal credit for business funding involves more than just maintaining a high credit score. It’s crucial to focus on building a comprehensive credit report that appeals to banks and financial institutions. Here’s how you can do it effectively:

Building a Personal Credit Report

- Get a Business Phone Number: Avoid using personal cell phone numbers as your business line. Invest in a dedicated business phone number, such as a toll-free 1-800 number, to present a professional image.

- Use a Professional Business Email: Ensure your business email is not a generic service like Gmail or AOL. Instead, use a domain-specific email address (e.g., yourname@yourbusiness.com) to enhance credibility.

- Establish a Business Address: While using a home address is common, it’s better to have a separate business address. This makes your business appear more established, similar to large corporations like Walmart or Target.

- Create an Online Presence: A professional website is essential. Banks may check your online presence to verify your business’s legitimacy, especially when you apply for substantial funding.

Importance of Credit Report Over Credit Score

“It’s about the credit report, not the score.”

Even with a high credit score, you can still be declined for funding if your credit report doesn’t meet the bank’s criteria. Banks scrutinize your credit report to assess your financial behavior and reliability.

Strategies for Fast Credit Report Build-Out

- Consistent Updates: Regularly update your credit report with accurate information.

- Diverse Credit Mix: Maintain a mix of credit types, such as credit cards, loans, and lines of credit, to demonstrate financial responsibility.

- Timely Payments: Ensure all payments are made on time to build a positive credit history.

By focusing on these elements, you can optimize your personal credit to secure the funding needed for business growth.

Maximizing Business Credit Card Benefits

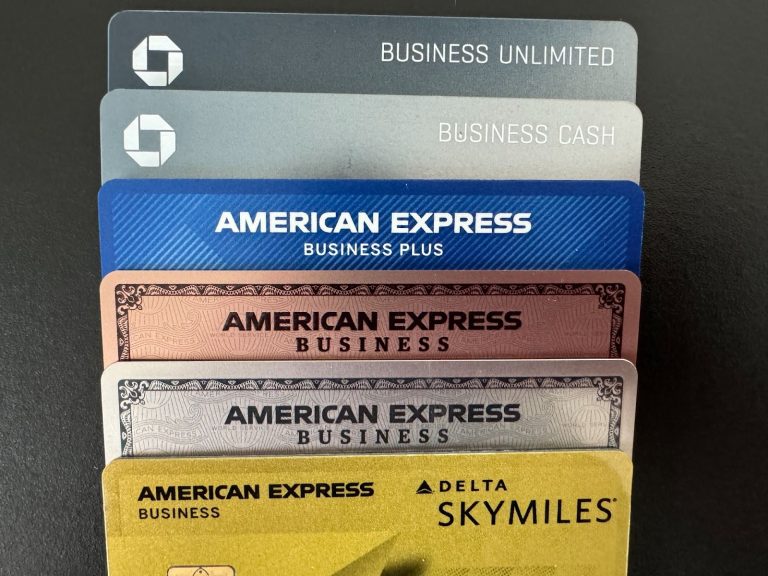

Maximizing the benefits of business credit cards can significantly enhance your business’s financial flexibility and growth potential. Here’s how you can make the most of these financial tools:

Advantages of Business Credit Cards

Business credit cards offer several advantages over personal credit cards:

- Higher Credit Limits: Business credit cards often approve you for two to three times higher limits compared to personal credit cards. This increased limit can provide more capital for business expenses.

- No Impact on Personal Credit: These cards do not report to your personal credit, which means your personal credit score remains unaffected by your business spending.

- Introductory Offers: Many business credit cards offer zero percent interest for twelve to eighteen months, allowing you to manage cash flow more effectively.

“Business credit cards approve you for two to three times higher limits. They don’t report to our personal credit. Zero percent interest for twelve months or eighteen months.”

Strategies for Using Business Credit Cards Effectively

- Establish an Online Presence: Having a website and a Duns and Bradstreet number can make your business more credible to banks.

- Open Multiple Accounts: Consider opening both checking and savings accounts for your business. This can help build a stronger relationship with your bank.

- Utilize Merchant Accounts: Opening a merchant account can further solidify your banking relationship, making it easier to request additional funds.

- Diversify Banking Products: Use a variety of banking products to demonstrate your commitment to a long-term relationship with your bank.

Banks Offering Favorable Business Credit Card Terms

While specific banks are not listed in the transcript, it is advisable to research and compare different banks to find those offering the best terms for business credit cards. Look for those with high credit limits, low or zero introductory interest rates, and favorable rewards programs.

By strategically using business credit cards, you can enhance your business’s financial health and set the stage for future growth.

Strategic Credit Application for Maximum Funding

When applying for credit to maximize funding, it’s crucial to focus on your credit report rather than just your credit score. A high score alone, such as 750 or 775, does not guarantee approval for substantial funding. Banks prioritize a well-structured credit report over the score itself.

“I strategically go get this money in a way that we can be able to maximize it.”

Understanding Credit Reports

Your credit report should reflect a strong relationship with multiple lenders. This means having several accounts in good standing, which demonstrates reliability and trustworthiness to potential lenders. For instance, if you have ten accounts with different lenders and pay them on time, you are more likely to be approved for larger sums than someone with only one account.

Strategy for Applying to Multiple Banks

To avoid excessive inquiries on your credit report, it’s essential to know which banks pull from which credit bureaus. This knowledge allows you to spread out your applications strategically, minimizing the impact on your credit report.

“We up sixty thousand, but we only got one inquiry in each bureau now.”

Accumulating Significant Funding

By establishing a robust credit report with multiple accounts, you can position yourself to receive significant funding. The goal is to build a trustworthy profile that encourages banks to extend more credit.

“Spread it out in the right manner so we can maximize how much money we get.”

Building Your Credit Report

Start by establishing at least ten accounts. This can be achieved quickly by opening accounts with various lenders. The more diverse your credit relationships, the better your chances of securing substantial funding.

By following these strategies, you can effectively maximize your funding potential through strategic credit applications.

Leveraging Multiple LLCs and Foreign Entities

In the pursuit of maximizing business funding, leveraging multiple LLCs and foreign entities can be a strategic approach. This method allows business owners to access a broader range of financial resources and opportunities. Here’s how you can effectively implement this strategy:

Opening Multiple LLCs for Increased Funding

One effective strategy is to open multiple LLCs. By doing so, you can “open up three to five LLCs,” which allows you to apply for separate lines of credit and business credit cards for each entity. This diversification can significantly increase your total available credit and provide a safety net if one LLC faces financial challenges.

Using Foreign Entities to Access Banks in Different States

Another tactic is to file what’s called a “foreign entity.” This process involves registering your LLC in another state, which can open doors to banks and financial institutions that may not be available in your home state. By doing this, you can tap into different banking systems and potentially more favorable credit terms.

Strategies for Maximizing Funding Across Multiple States

To maximize funding across multiple states, consider the following strategies:

- Research State-Specific Opportunities: Each state may offer unique financial incentives or programs for businesses. Understanding these can help you tailor your approach to each state’s offerings.

- Build Relationships with Local Banks: Establishing connections with banks in different states can provide insights into local financial landscapes and opportunities.

- Leverage State-Specific Credit Products: Some states may have credit products that are not available elsewhere. By leveraging these, you can enhance your funding options.

By strategically leveraging multiple LLCs and foreign entities, you can expand your business’s financial reach and create a robust framework for growth. This approach not only diversifies your funding sources but also positions your business to take advantage of varied financial landscapes.