Navigating Major Credit Reporting Changes in 2025

Major Credit Reporting Changes in 2025

In 2025, significant changes are set to reshape the landscape of credit reporting, with major implications for individuals across the United States. On March 17th, these changes will come into effect, marking a pivotal moment in how credit scores are calculated.

One of the most impactful changes is the removal of medical bills from credit reports. This initiative, finalized by the Consumer Financial Protection Bureau (CFPB), aims to alleviate the financial burden that medical debt places on consumers. Medical collections have long been a contentious issue in credit reporting, often disproportionately affecting individuals’ credit scores and their ability to access financial products.

Beginning on March 17th, medical collections will be systematically removed from credit reports. This transition is expected to lead to significant improvements in credit scores for many individuals, with potential increases ranging from 30 to 60 points. Such boosts can have a profound impact on a person’s financial health, enhancing their ability to secure loans and favorable interest rates.

This change follows a finalized rule announced on January 7th, granting a 60-day period for implementation. The removal of medical debt from credit reports represents a major shift in consumer protection and financial fairness.

As we approach this implementation date, it’s crucial for individuals with medical collections on their reports to monitor these changes closely. The potential uplift in credit scores offers an opportunity for improved financial planning and access to better financial products. Stay informed about these developments and understand how they can positively influence your financial future.

Understanding the CFPB’s Role

The Consumer Financial Protection Bureau (CFPB) plays a pivotal role in the evolving landscape of credit reporting, especially concerning the removal of medical debts from credit reports. While the CFPB’s recent rule to eliminate medical collections from credit reports is a significant relief for many, it’s critical to understand the broader implications of this change.

‘The CFPB’s Function and Medical Collections”

The CFPB serves as a watchdog for consumers, primarily focusing on ensuring fair treatment in financial dealings. It acts as a middleman, processing consumer complaints and facilitating communication between consumers and financial institutions. While it doesn’t control credit reporting processes directly, it oversees consumer complaints that can lead to significant investigations and legal actions.

The recent rule change by the CFPB mandates that medical debts be removed from credit reports starting March 17th, a move set to benefit millions by potentially boosting their credit scores. However, this removal doesn’t eliminate the debt itself—creditors can still pursue collection efforts based on state-specific statutes of limitations.

“Disputing Medical Collections”

Even with medical debts removed from reports, consumers must remain vigilant about these collections. Disputing any lingering medical collections is essential, especially given that creditors might increase legal actions due to loss of leverage over consumers’ credit reports. The CFPB recommends disputing these collections through a straightforward process involving contacting credit reporting agencies directly.

“Legal Actions and Implications”

Despite these changes, the status of the CFPB itself has been in flux. Recently paused actions mean uncertainty over ongoing rules and regulations. Notably, some major cases have been dismissed under new administrative directives. This uncertainty stresses the importance for consumers to remain proactive in managing their disputes and staying informed about potential shifts in enforcement policies.

In summary, while the CFPB’s efforts significantly contribute to consumer protection by removing burdensome medical debts from credit reports, it remains crucial for individuals to understand that this does not erase the debt itself. Continued vigilance in disputing collections and understanding legal implications is vital as these changes unfold.

FHA and Fannie Mae Credit Score Updates

The financial landscape is undergoing significant changes, particularly in the realm of credit scoring. Among the most noteworthy updates are those announced by the Federal Housing Administration (FHA) and Fannie Mae, concerning how credit scores will be evaluated for prospective homebuyers.

“Transition from Tri-Merge to Bi-Merge Reports”

Traditionally, when attempting to purchase a home, lenders would conduct a tri-merge report. This process involves pulling credit information from all three major credit bureaus: TransUnion, Equifax, and Experian. However, a shift is on the horizon as FHA and Fannie Mae plan to transition to bi-merge reports. This means that only two of the three credit reports will be considered. This change is expected to be implemented by the fourth quarter of 2025.

“Introduction of VantageScore 4.0”

Alongside this transition, there’s a pivotal change in the scoring model used for mortgage lending. Instead of relying on FICO scores, which have long been the standard, lenders will now utilize VantageScore 4.0 for evaluating mortgage applications. This newer model is considered more advanced and is expected to be used exclusively within the mortgage lending sector by Fannie Mae and Freddie Mac.

The adoption of VantageScore 4.0 could potentially open doors for more individuals seeking homeownership by offering a slightly different perspective on creditworthiness compared to traditional models.

“Implications for Homebuyers”

These changes are poised to influence many prospective homebuyers positively by potentially broadening access to mortgage products. However, it’s crucial for individuals looking to purchase homes within this new framework to maintain robust credit scores.

Homebuyers are urged not to fall into traps set by lenders who promise easy access with lower credit score requirements like 580 or lower. Such offers could lead to unfavorable financial situations with high interest rates and eventual refinancing challenges.

“Market Considerations”

Though these updates provide fresh opportunities in homebuying, it’s essential to approach with caution given current market conditions characterized by high prices and increasing insurance rates in states like Florida and Texas.

In conclusion, while these changes represent significant advancements in how creditworthiness is evaluated for mortgages, aspiring homeowners must remain diligent in monitoring their credit health and understanding market dynamics before making purchasing decisions.

AI in Credit Scoring

As the financial landscape evolves, the role of artificial intelligence (AI) in credit scoring is becoming increasingly significant. This advancement is set to transform how financial institutions evaluate creditworthiness, potentially impacting consumers in profound ways.

“Introduction to AI in Credit Scoring’

AI in credit scoring represents a shift from traditional methods, offering new opportunities and challenges. While conventional credit models have relied heavily on static data, AI models can analyze vast amounts of alternative data points, providing a more nuanced view of an individual’s financial behavior. This transition is expected to begin towards the end of the year, marking a pivotal change in how credit scores are determined.

“Alternative Data Points Considered by AI”

AI’s ability to process a plethora of data sources opens up new dimensions in credit scoring. These models can consider bank account transactions and cash flow data, offering insights into an individual’s financial habits that traditional scores might overlook. Additionally, utility and telecom payment records are expected to play a role, reflecting the consumer’s ability to manage regular expenses like gas, electricity, and phone bills.

Rental payment history is another critical addition. Historically excluded due to its non-credit nature, rental payments are now seen as vital indicators of financial responsibility. Companies like Boom Report are enabling this by providing services that report rental payments to credit bureaus.

Educational and occupational data will also be factored in. This includes information about where someone studied or worked and for how long. Such data can offer predictive insights into an individual’s earning potential and stability.

Public records such as property ownership and court judgments may return to prominence in evaluations. Additionally, psychometric data from quizzes or games may be analyzed for behavioral insights.

Finally, social media activity and online behavior are areas where AI might delve deeper than ever before. While this raises concerns about privacy and freedom of expression, it also highlights the extent to which personal habits could influence credit evaluations.

“Potential Implications for Consumers”

The implications of AI-driven credit scoring are significant for consumers. On one hand, it could democratize access to credit by recognizing positive behaviors that traditional scores miss. On the other hand, it raises privacy concerns as more personal data becomes integral to financial evaluations.

It’s crucial for consumers to remain informed about how these changes could affect their financial standing. While AI offers a more comprehensive view of one’s financial life, it also requires individuals to be more vigilant about their digital footprint and overall lifestyle choices.

As we move towards this new era in credit scoring driven by AI technology, understanding these shifts will be vital for navigating future financial opportunities effectively.

Credit Repair with DisputeBeast

n the ever-evolving world of credit repair, DisputeBeast emerges as a powerful tool designed to help individuals navigate the complexities of credit reporting and improve their credit scores. Understanding the impact of artificial intelligence (AI) on financial decisions, DisputeBeast leverages cutting-edge technology to provide personalized solutions for users seeking credit repair.

“Overview of DisputeBeast Software”

DisputeBeast offers a comprehensive approach to credit repair by utilizing AI technology that analyzes individual credit reports and identifies inaccuracies. Unlike traditional methods that often rely on template-based letters, DisputeBeast creates custom strategies tailored to each user’s unique financial situation. This personalized approach ensures that users are not only addressing their current credit issues but are also building a foundation for long-term financial stability.

The software is particularly effective in dealing with items like medical collections, which are set to be removed from credit reports by March 17th. Even though these collections will no longer impact credit scores, individuals must remain vigilant as creditors may still pursue collection efforts legally.

“Success Stories and Testimonials”

The success of DisputeBeast is evident in the myriad testimonials from users who have experienced significant improvements in their credit scores. For instance, one user reported a remarkable increase from 680 to 725 within a short period, attributing this success to the tailored strategies provided by DisputeBeast. Another user celebrated a jump of over 200 points in just one year, highlighting how effective the software can be.

These stories emphasize the importance of celebrating each other’s wins within the community. Recognizing personal achievements not only boosts morale but also reinforces the collective goal of achieving better financial health.

How DisputeBeast Works

DisputeBeast operates by analyzing your credit report and pinpointing inaccuracies or outdated information that may be negatively affecting your score. The AI technology then generates custom dispute letters targeting these specific issues. This process is repeated over several rounds—typically four to six—to ensure maximum impact on your credit score.

Users are encouraged to remain patient and persistent through this process, as improvements may not be immediate but can lead to substantial long-term benefits. Additionally, integrating sound financial habits alongside using DisputeBeast can amplify results

DisputeBeast also offers support for users dealing with medical debt that falls under state-specific statutes of limitations. By offering links and resources like Dollar For and healthcare reform advocacy groups, it provides avenues for debt reduction or elimination outside traditional dispute methods.

In conclusion, DisputeBeast stands out as a leading tool in the realm of credit repair due to its innovative use of AI technology and its commitment to helping users achieve better financial outcomes.

Financial Habits and Credit Management

In today’s fast-paced financial world, cultivating good financial habits and effective credit management strategies is crucial for reaching your long-term financial goals. Many people ask how long it takes to improve credit, and the answer varies depending on individual circumstances. It often requires dedication and persistence, with some needing four to six rounds of credit repair efforts, while others may require up to twenty rounds.

The journey to better credit can be daunting, especially if your credit report is burdened with multiple negative items like charge-offs. It’s essential to approach this process with patience and a commitment to putting in the necessary work. Typically, it can take four to six months, but in some cases, it may extend up to a year or more.

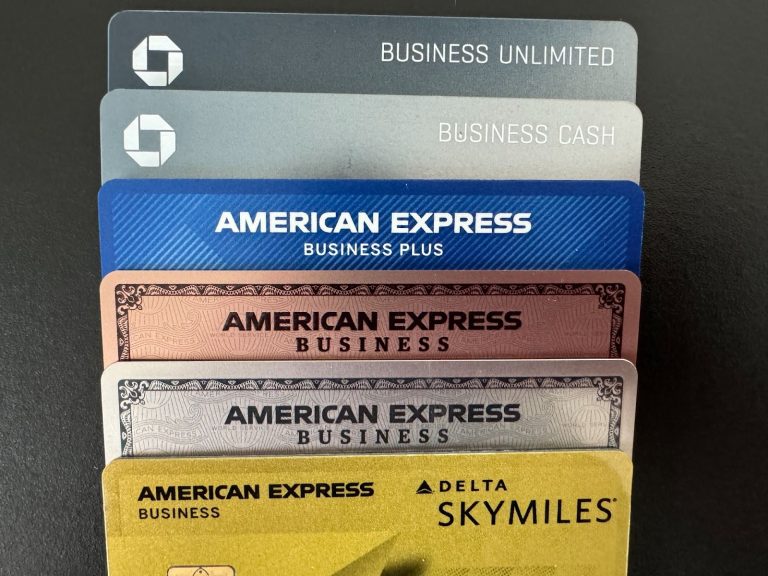

One effective strategy is starting with entry-level credit cards from reputable institutions like Navy Federal. These cards provide a solid foundation for building credit while maintaining financial discipline by paying off balances in full every month. This approach not only improves your credit score but also positions you for better offers from the institution.

Maintaining low credit utilization is another key aspect of good financial habits. Ideally, keeping utilization between zero and six percent maximizes your score potential while avoiding unnecessary interest payments. Many people mistakenly believe carrying a balance improves their score; however, aiming for zero debt is more beneficial in the long run.

It’s also important to keep all your credit cards active by making small purchases or setting up automatic payments for regular expenses. This prevents card issuers from closing inactive accounts and helps maintain healthy account history.

Engaging with larger credit unions offers significant advantages over traditional banks like Bank of America or Wells Fargo. Credit unions often provide higher limits due to their larger member base and offer more favorable terms on loans and credit products.

A strategic move for boosting your internal score with a credit union involves opening both checking and savings accounts, maintaining substantial balances without frequent withdrawals, and setting up direct deposits. Furthermore, taking out a secured loan or pledge loan helps establish a strong relationship with the institution while demonstrating financial responsibility.

Paying off most of this secured loan quickly reduces interest costs significantly and positions you for approvals on other financial products like high-limit credit cards or personal loans.

Finally, evaluating whether or not to cancel low-limit or high-fee cards is crucial as closing such accounts can negatively impact your average age of accounts—a critical component affecting your overall score.

By implementing these strategies diligently over time, you can significantly enhance your financial profile and open doors to more favorable lending opportunities.

Conclusion

it’s crucial to remember that everyone’s financial journey is unique. What works for one person might not work for another, and that’s okay. It’s all about finding the strategies that align best with your personal financial goals and circumstances.

One of the key takeaways is the importance of building a strong relationship with your credit union. Whether you have excellent credit or are working to improve it, establishing and nurturing this relationship can greatly impact your financial opportunities. As highlighted, even with a modest credit limit, it’s about showing consistency and reliability.

Also, be mindful of the pitfalls associated with certain credit card companies. Some are known for charging high fees while giving little in return. It’s important to be cautious and informed about where you are putting your trust.